One of those roads turned to gravel – and more potholes

❝ After living more than 40 years along a road plagued by potholes, Jo Anne Amoura was excited to see city crews shred her block of Leavenworth Street into gravel.

“I thought, ‘Oh my gosh, this is great. We’re going to get a new street,’” Ms. Amoura recalled. “And then we waited and waited and waited.”

Fresh pavement never arrived. Only after the asphalt had been ripped out almost three years ago did Ms. Amoura and her neighbors learn that their street had been “reclaimed,” Omaha City Hall’s euphemism for unpaving a road…

❝ As in many big cities, the infrastructure here is crumbling, a problem exacerbated by decades of neglect and a network of residential roads, including Ms. Amoura’s, that have never met code. But Omaha’s solution is extreme: grinding paved streets into gravel as a way to cut upkeep costs…

❝ While President Trump has called for extensive investments in infrastructure, federally funded efforts are likely to go to decaying interstate highways and airports and dams. Some experts estimate that $1 trillion is needed to repair roads, bridges and rail lines over the next decade.

But infrastructure is also decaying at the most local levels — on cul-de-sacs and in neighborhood playlots unlikely ever to see federal funding. So cities like Omaha have resorted to unusual solutions…

“This isn’t something that happened over one year or two years,” said Brooks Rainwater, a senior executive and the director of the Center for City Solutions at the National League of Cities. “This has been decades of not investing in our infrastructure.”

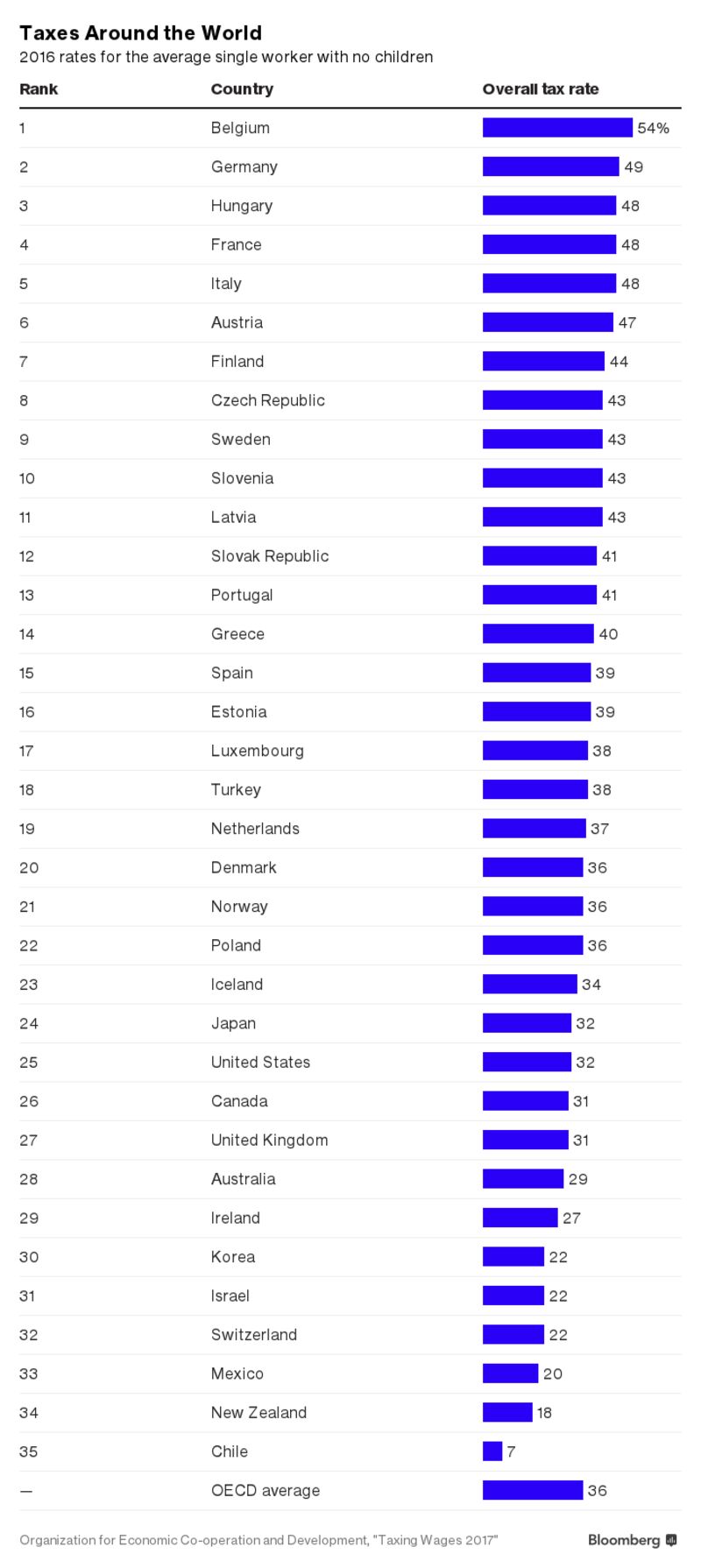

Thing is, taxpayers have been paying their taxes. The ordinary citizens who have been living and working in America’s cities for generations. Politicians keep trying to attract industry by NOT collecting taxes from the new guys at the top of the scale. Maybe promising lower taxes for their executive class, as well.

Yes, it’s not just a Republican problem at the front end. Both clubhouses in our incompetent 2-party private political association are less than understanding of economics beyond slogans. But, the right-hand side of that 2-party equation ain’t about to begin supporting legislation and regulations that fill life’s needs for folks who work for a living. That’s reserved for the important people.

RTFA for the details, folks. It ain’t a surprise, anywhere in the GOUSA.